Responsible Officers and Employees Can Be Held Personally Liable for New Jersey Sales Tax Collection Obligations Even When the Seller Corporation is No Longer “On the Hook”

An Explanation of Responsible Person Liability: The New Jersey Sales Tax is known as a “trust fund tax.” While sales tax is imposed upon the purchaser, it is the seller that has the obligation to collect and remit the tax to the New Jersey Division of Taxation (the Division). This…

K&D Shareholder, Joseph Kempter awarded the 2025 EFPC Founder’s Award

Kulzer & DiPadova, P.A. is pleased to announce that shareholder, Joseph Kempter has been awarded the 2025 EFPC Founder’s Award. The EFPC Founder’s Award is presented to an individual who has provided distinguished service to the estate and financial planning profession. The award recipient need not necessarily be a member…

K&D Shareholder, Kristin L. Schmid elected to President of EFPCSJ

Kulzer & DiPadova, P.A. is pleased to announce that shareholder, Kristin L. Schmid has been elected President of the EFPCSJ (Estate and Financial Planning Council of Southern New Jersey). The EFPCSJ is a professional association of estate and financial planning practitioners in southern NJ. Ms. Schmid earned her J.D. from…

NEW JERSEY SUPREME COURT TAKES A SURPRISING APPROACH TO ADDRESS A DECEDENT’S LACK OF ATTENTION TO DETAIL AFTER GETTING DIVORCED

In a recent New Jersey Supreme Court case, Matter of Estate of Jones, 25 N.J. 584 (2025), a unanimous court found that a decedent’ s ex-wife was entitled to retain United States savings bonds that the decedent owned and that designated her as the beneficiary, notwithstanding the fact that the…

New FinCEN Rule Exempts US Companies from Reporting Requirements

On March 21st, the Financial Crimes Enforcement Network (FinCEN), Treasury, issued interim final rules that eliminate the requirement of U.S. entities to report the Beneficial Ownership Information (BOI) reporting requirements as required by the Corporate Transparency Act (CTA). This represents the complete reversal of rules previously issued by FinCEN under…

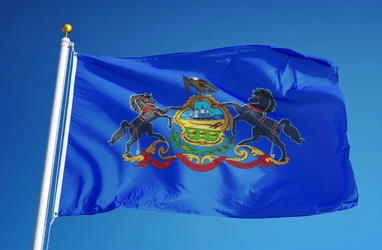

New Annual Reporting Requirement for Pennsylvania Entities

Background On November 3, 2022, Governor Wolf signed Act 122 of 2022[1] (the “Act”) into law, implementing significant changes for domestic and foreign filing entities in the Commonwealth of Pennsylvania. Among the many changes made by this legislation, the Act created an annual reporting requirement for most domestic and foreign…

Sponsor a Defined Benefit Plan? March 31, 2025 Restatement Deadline Approaching

PLAN RESTATEMENTS The Internal Revenue Service (“IRS”) requires that all pre-approved qualified retirement plan documents be restated in their entirety every six (6) years (this period is often referred to as the “Restatement Cycle”). Pre-approved plans subject to this mandate consist of prototype plan documents. A prototype plan document is…

K&D Shareholder, Eric A. Feldhake inducted as President of the American Wine Society

Kulzer & DiPadova, P.A. is pleased to announce that shareholder, Eric A. Feldhake has been inducted as President of the American Wine Society. Mr. Feldhake is a shareholder with the firm. He earned his J.D. at Temple University School of Law, where he was a senior editor of the Temple…

Form 5471 Late Filing Penalties and Protective Refund Claims

The Internal Revenue Service (“IRS”) Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, is one of the most complicated international information reporting forms that some U.S. taxpayers may have to file each year depending on the U.S. taxpayer’s direct or indirect ownership in a foreign…

K&D Shareholder, Joseph T. Kenney appointed to the BCRCC Board of Directors for 2025

Kulzer & DiPadova, P.A. is pleased to announce that shareholder, Joseph T. Kenney has been appointed to the Board of Directors for the Burlington County Regional Chamber of Commerce for 2025. Mr. Kenney is a shareholder with the firm and is a graduate of LaSalle University and Rutgers University School…