New Jersey Enacts Salt Work-Around Pass-Through Entity Tax

On January 13, 2020, Governor Murphy signed into law P.L.2019, c.320 (S3246/A4807) the “Pass-Through Business Alternative Income Tax Act.” The new law establishes an elective entity-level alternative income tax (AIT) to be paid by pass-through entities (PTEs). Pass-through income remains taxable to owners, but the new law grants a refundable credit designed to offset new entity level tax paid on that income. The new law applies to taxable years of PTEs beginning on or after January 1, 2020.

The new law is New Jersey’s latest response to the controversial $10,000 limitation on individual state and local tax deductions introduced by the federal Tax Cuts and Jobs Act of 2017 (TCJA). The federal limitation applies for tax years beginning after December 31, 2017 and before January 1, 2026. The TCJA does not limit the deduction of state and local taxes for business entities. New Jersey’s new law seeks to bring parity to the federal tax treatment of state taxes paid on business income from PTEs and state business income taxes paid by taxable C corporations.

As devised, an electing PTE would deduct the AIT when determining its federal income. Allowing a PTE to deduct its AIT as a business tax at the entity level reduces an owner’s distributive share of federal taxable income from that entity. The AIT is not deductible when computing the PTE’s New Jersey income.

Entities Eligible to Make the Election. Pass-through businesses eligible to elect to pay the AIT are S corporations, partnerships, and limited liability companies classified as partnerships if the entity has at least one member liable for tax under the New Jersey Gross Income Tax Act (GIT) on a distributive share of entity income. Single member limited liability companies and sole proprietorships may not elect to pay the AIT.

Making the Election. An entity’s election under the AIT is made annually by the due date of the entity’s return. The election cannot be made retroactively. Members of the PTE can revoke an election by the due date of the entity’s return. The election must be made with the consent of each member of the electing entity who is a member when the election is filed or by an officer, manager, or member of the electing entity authorized, under law or the entity’s organizational documents, to make the election and who represents to having such authorization.

The Entity Tax. An electing entity must pay tax on the sum of each owner’s share of distributive proceeds attributable to the pass-through entity for the taxable year. “Distributive proceeds” include the net income, dividends, royalties, interest, rents, guaranteed payments, and gains of a PTE from New Jersey sources which are taxable under the GIT.

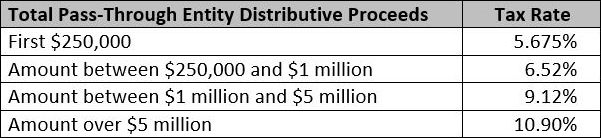

The AIT is imposed under a graduated rate schedule.

Electing PTEs must file an entity tax return and make payments by the 15th day of the third month following the close of the entity’s taxable year, March 15 for calendar year PTEs. This filing date is one month earlier than the April 15 return filing date required of non-electing PTEs but corresponds with the entity’s federal return due date.

PTEs must make estimated entity tax payments by the 15th day of each of the fourth month, sixth month, and ninth month of the taxable year and by the 15th day of the first month succeeding the close of the taxable year. For calendar year PTEs the estimated tax filings are due on April 15, June 15, September 15, and January 15 of the following year.

Owner’s GIT Income and Credit. An owner of an electing PTE must include the owner’s distributive share of PTE items in New Jersey gross income, as under prior law. However, the owner of an electing PTE is allowed a refundable GIT credit for a share of the AIT paid by the PTE. For each electing PTE owned, the GIT credit equals the owner’s pro rata share of the tax paid. The credit is granted after all other credits of the taxpayer have been taken. If the PTE credit exceeds the tax otherwise due, the excess is an overpayment and can be refunded or applied against the owner’s estimated tax for the succeeding taxable year. The PTE credit allowed a trust or estate can be allocated to the beneficiaries or be used against the tax liability of the trust or estate under rules to be adopted by the Division of Taxation.

Corporate Owners. While the AIT is intended to benefit noncorporate owners, PTEs may have corporate members. The new law has provisions governing the taxation of corporate owners, including corporate owners filing as a combined group.

Credit for Similar Taxes Paid to Other States. A New Jersey resident owner may claim a credit against the GIT for the tax of another state substantially similar to the AIT. The credit cannot exceed the amount allowed if the income of the PTE was taxed at the individual level and not taxed at the entity level. The Division of Taxation will identify taxes of other states substantially similar to the AIT.

State Guidance Anticipated. Guidance and forms for the administration and collection of the new tax, for claiming the tax credit, and for applying the credit to estates and trusts will be required from the Division of Taxation.

IRS Uncertainty. Some commentators have raised federal tax concerns regarding the deductibility of optional PTE taxes, like that enacted by New Jersey. The IRS recently issued final rules prohibiting the use of state tax credits for donations made to charitable funds created under state programs. Yet the IRS has not addressed the federal deductibility of PTE-level taxes. It remains unclear whether the IRS will address the federal tax consequences of state PTE taxes. Until it does, there will be uncertainty regarding the federal deduction of PTE taxes.

Upcoming NJCPA Webcast. Thursday, January 30, 2020, K&D attorneys James B. Evans, Jr., Glenn A. Henkel, and Joseph M. Kempter will be presenting a timely webcast coordinated by the NJCPA. The program will examine:

- The New Jersey Pass-Through Business Alternative Income Tax Act enacted on January 13. This new law impacts how S Corporations, partnerships, LLCs and their owners are taxed in New Jersey.

- The recently enacted Setting Every Community Up for Retirement Enhancement (SECURE) Act which contains major changes affecting IRAs and employer-based retirement plans.