Kulzer & DiPadova, P.A. has been serving the South Jersey and Greater Philadelphia communities as a boutique tax, business, and estate planning law firm for over 50 years.

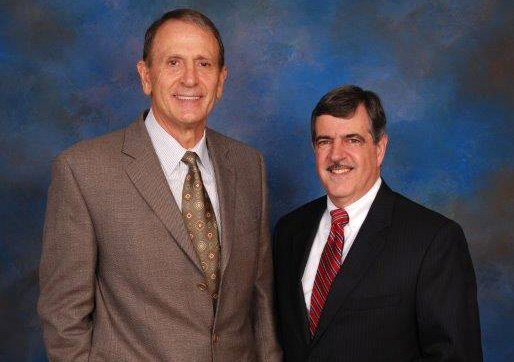

The firm’s humble beginnings started when Michael A. Kulzer began his solo law practice in 1971. Arthur A. DiPadova joined Mike in 1976 and Kulzer DiPadova, P.A. was born. Initially the firm operated out of a small office on Kings Highway in Haddonfield, New Jersey. Years later, Kulzer & DiPadova moved to its current location at 76 E. Euclid Avenue, Haddonfield, New Jersey. Since its inception the firm has grown to 14 attorneys, and over 20 support staff.

The firm’s humble beginnings started when Michael A. Kulzer began his solo law practice in 1971. Arthur A. DiPadova joined Mike in 1976 and Kulzer DiPadova, P.A. was born. Initially the firm operated out of a small office on Kings Highway in Haddonfield, New Jersey. Years later, Kulzer & DiPadova moved to its current location at 76 E. Euclid Avenue, Haddonfield, New Jersey. Since its inception the firm has grown to 14 attorneys, and over 20 support staff.

All of Kulzer & DiPadova’s attorneys have earned their Masters of Law (LLM) in Taxation, and several are also Certified Public Accountants. Our specialized focus and knowledge allow Kulzer & DiPadova to provide exceptional counsel to our clients in a wide array of matters ranging from state & local taxes, estate planning and administration, estate litigation, civil and criminal tax controversies, business tax planning and compliance, and beyond.

The culture of our firm stems from our dedicated attorneys and experienced staff who are committed to providing the highest level of service to our clients.

Firm Timeline

Michael A. Kulzer opens his solo law practice in Cherry Hill, NJ.

Michael A. Kulzer opens his solo law practice in Cherry Hill, NJ.

Michael A. Kulzer teaches accounting, tax, and business law as an assistant professor at Rutgers Camden from 1971-1978

Michael A. Kulzer, P.A. is incorporated

September

Arthur A. DiPadova starts clerkship

Arthur A. DiPadova is named Associate

Arthur A. DiPadova is named Shareholder and the firm is renamed to Kulzer & DiPadova, P.A.

Firm moves from Cherry Hill office to 35 Kings Hwy, Haddonfield

July

July

James B. Evans, Jr. joins the firm as a law clerk, he is named Associate the following year

Michael A. Kulzer receives the Hon. Peter J. Devine, Jr. Award from the CCBA for distinguished service to the Bar

Barbara A. Kulzer is named Counsel to the firm

January

James B. Evans, Jr. is named Shareholder

Robert H. Williams joins firm as Associate

Robert H. Williams named Shareholder

Robert H. Williams named Shareholder

Glenn A. Henkel joins the firm as a law clerk, he is named Associate the following year

February

The firm moves on Valentine’s Day to it’s current location on 76 E. Euclid Avenue during a snowstorm

October

Tax Reform Act of 1986 is signed into law by President Ronald Reagan on October 22, 1986. It would be the most extensive review and overhaul of the Internal Review Code since the inception of the income tax in 1913. It’s purpose was to simplify the tax code, broaden the tax base, and eliminate many tax shelters and preferences.

December

December

Joseph T. Kenney joins firm as an Associate

January

January

Glenn A. Henkel is named Shareholder

The Uniform Probate Code is revised in 1990 and is modeled on the 1969 version of the UPC.

Arthur A. DiPadova serves as President of the Estate and Financial Planning Council of Southern New Jersey (1991-1992)

January

January

Joseph T. Kenney is named Shareholder

May

May

Joseph M. Kempter joins the firm as a law clerk, he is named Associate the following year

Glenn A. Henkel serves as President of the Estate and Financial Planning Council of Southern New Jersey (1998-1999)

Barbara A. Kulzer retires as Professor of Law after 20 years of teaching at Rutgers University School of Law where she also served as Associate Dean

Michael A. Kulzer serves as President of the Camden County Bar Association (2001-2002)

February

February

Eric A. Feldhake joins firm as Associate

May

May

Douglas R. Madanick joins the firm as a law clerk, he is named Associate the following year

Joseph M. Kempter named Shareholder

Joseph M. Kempter named Shareholder

Arthur A. DiPadova serves as President of the Society of Financial Service Professionals – South Jersey Chapter

James B. Evans, Jr. serves as President of the Southwest Jersey Chapter New Jersey Society of Certified Public Accountants (2003-2004)

Joseph T. Kenney serves as President of the Southwest Jersey Chapter of the New Jersey Society of Certified Public Accountants (2006-2007)

Joseph M. Kempter serves as President of the Estate and Financial Planning Council of Southern New Jersey (2008-2009)

January

January

Eric A. Feldhake is named Shareholder

May

May

Daniel L. Mellor joins the firm as a law clerk, he is named Associate in August

January

January

Douglas R. Madanick is named Shareholder

January

January

Michael J. DeLaurentis is named Counsel to the firm

November

The firm mourns the sudden passing of Barbara A. Kulzer

May

May

Samantha Heaton starts clerkship, she is named Associate the following year

January

New Jersey’s Uniform Trust Code is enacted on January 19, 2016 and becomes effective July 17, 2016. Shareholder Glenn A. Henkel was one of the key principals on the NJ bar association committee to conform the UTC to New Jersey law as adopted by the Uniform Law Commission

March

March

Kristin L. Schmid joins firm as Associate

Michael A. Kulzer receives the Founders Award from the Estate and Financial Planning Council of Southern New Jersey

The Tax Cuts and Jobs Act is signed into law by President Donald Trump on December 22, 2017 a sweeping tax reform law that promised to entirely change the tax landscape.

January

January

Daniel L. Mellor named Shareholder

New Jersey Estate Tax is eliminated effective January 1, 2018. First enacted in 1934, it’s purpose was to ensure New Jersey receives the full amount of the Credit for State Death Taxes allowed against the Federal Estate Tax.

January

Kristin L. Schmid named Shareholder

Kristin L. Schmid named Shareholder

Solaris Power joins firm as Associate

Solaris Power joins firm as Associate

June

Arthur A. DiPadova receives 2021 Founders Award for Lifetime Achievement from the Estate and Financial Planning Council of Southern New Jersey.

May

May

PEPC Awards Glenn A. Henkel 2022 Mordecai Gerson Meritorious Service Award

SEPTEMBER

Michael R. Noto joins the firm as an associate.

January

Samantha Heaton becomes a shareholder.

SEPTEMBER

Caroline C. Sutherland joins the firm as an associate.

AUGUST

William H. Dungey, III joins the firm as an associate.

July

July

December

December February

February May

May May

May January

January